If you’ve celebrated your 55th birthday and planning your retirement to lead life comfortably in your own sweet home, equity release could be the right option for you. Yes, if you own a home and decide to live the rest of your life peacefully while getting a steady flow of income, or a lumpsum that is tax-free, equity release is what you should seriously consider.

If you’ve celebrated your 55th birthday and planning your retirement to lead life comfortably in your own sweet home, equity release could be the right option for you. Yes, if you own a home and decide to live the rest of your life peacefully while getting a steady flow of income, or a lumpsum that is tax-free, equity release is what you should seriously consider.

It has been observed that people in increasing numbers are considering equity release in the U.K. While the chief reason remains obvious, there is more you should know. Read through to get a better insight into the reasons to consider equity release.

1. Pay off Secured Loans/Mortgages

It is estimated that around 32% use equity release to pay off their existing mortgages. This is certainly a good option since you will not be required to worry or shell out a part of your savings or small revenues during your retirement period. An equity release allows you to live your full life in your property and the cost of the lifetime mortgage along with the interest is paid off once your property is sold.

This is one of the many top reasons people are considering equity release. While you will have more money to spend on daily essentials, it is also possible to get rid of loan headaches.

2. Home Make-over Funding

Over 20 percent of homeowners in the U.K consider equity release to fund their home improvement project. If you are planning to give your home a makeover to spend your retirement days in the manner you dreamed, well, equity release can come in handy. It enables you to unlock the wealth of your property while still living in it. In other words, you can benefit from an income from your property without selling it. You could even plan your home renovation to help your family members live a lifestyle to align with the modern trends. Add a loft, give a facelift to your garden, enhance the curb appeal and add value to your property- all with no extra burden or stress!

3. Do Not Want To Move

Most of the retired people do not want to move out of their homes. They do not want the stress associated with moving into a new place or home, neither do they want to move into cheaper properties. If you are one among them, equity release is the best choice. Live in your own family home until your last breath while still getting rid of debts and unwanted financial worries; equity release is here.

4. Help Children

If your son or daughter has got entangled in student debt or struggling to get on to the housing ladder, you may part with some of the cash you earn with equity release. The cost of living is skyrocketing, rental expenses are steadily increasing while the salaries have remained stagnant. Support the younger generation of your family even when you retire and take pride as they grow comfortably with your backing.

Do not think that everything ends with retirement. With proper financial planning, you can still lead a comfortable life while supporting your family’s funding needs. Get in touch with a reliable financial planning services provider if you seriously want a peaceful retirement. We, Simple Financial Planning, can be a good choice.

5. Clear Debts

Around 10 percent of the people use equity release to consolidate existing debts. Yes, it is agreed that the rates are generally higher than the ones prevailing for standard mortgages but because you pay nothing when you are alive, that shouldn’t be a worry.

Clear your debts and live a stress-free retired life; why have outstanding debts and struggle to make payments when you can clear them off with ease?

However, it is recommended that you think twice before securing debt against the property you own since it could increase the overall cost of borrowing. Clearing off the debts is definitely one of the top reasons to consider equity release but as mentioned earlier, determine the overall cost before jumping into it. At Simple Financial Planning, we can offer top-class advice to enable you to make an informed decision.

6. Fund Dream Lifestyle

Like several people out there, you might have dreamed of luxury holidays or just living your life the way you want to but money and family responsibilities might have always restricted you from doing so. An equity release equips you to spend the later part of your life in accordance with your dreams and wishes by providing a lumpsum. What’s more! It is tax-free!! Enjoy your free time by encasing on your property worth and live life fully. Buy a car, travel, spend on your hobbies, play golf or just laze around.

Retirement should be relaxed, not stressed; this is why you need financial planning.

7. Enhance Cashflow

Do you get sufficient pension to cover all your expenses? Are you planning an early retirement? Are you prepared enough financially?

If your pension is insufficient hence looking for ways to cover your expenses during your retirement days, equity release could be a great option. It provides lumpsum or steady income in chunks, thereby enhancing your cashflow. However, be careful; you should also consider benefit entitlements/ what you want to pass on to your family after your death. Consult a financial advisor who can guide you right if you have the least idea relating to the same.

Equity Release no doubt gives you financial freedom post the age of 55 or after retirement, but it might affect some State benefits such as savings credit and pension credit. Moreover, over the years, interest will accumulate.

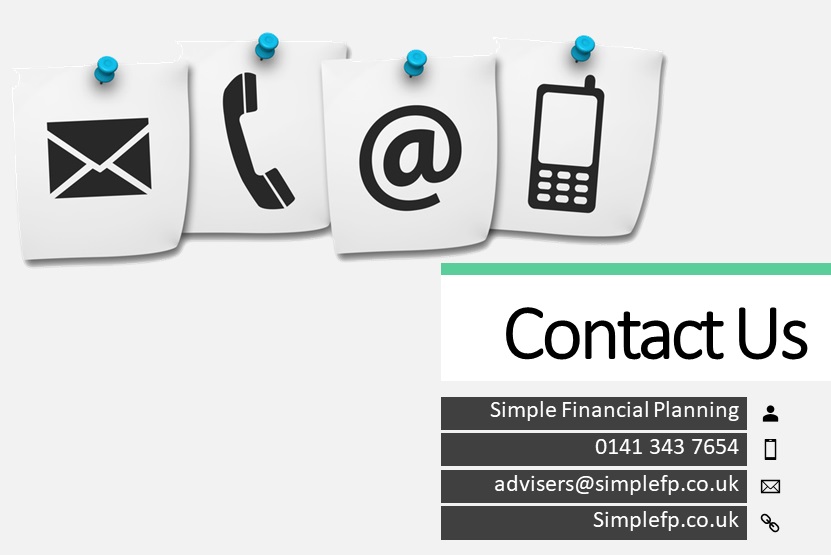

Contact Expert Advisers at Simple Financial Planning

It doesn’t matter whether you need help with insurance, debt, mortgage, saving or investment, we at Simple Financial Planning can assist you. Our expert financial advisors come with rich experience in the industry, therefore can guide you precisely. We offer a personalized approach and help you choose the best money plan.

Call us for information on equity release; our dedicated advisors will be glad to provide all the details you need.

More Information

You can also watch our video for more information on Equity Release and get some insights from the exports to help you understand what it is all about. Simple Financial Planning is here to help and to make the process as Simple as possible for you!