We have continued to experience a sharp downturn in global equity markets over the last two weeks, in response to persistently high inflation and rising interest rates. The majority of asset classes and geographic regions have been affected, with the S&P 500 and NASDAQ indices in the US down by 23% and 32% respectively so far this year. At the same time, we have also seen increased volatility in the bond markets.

We have continued to experience a sharp downturn in global equity markets over the last two weeks, in response to persistently high inflation and rising interest rates. The majority of asset classes and geographic regions have been affected, with the S&P 500 and NASDAQ indices in the US down by 23% and 32% respectively so far this year. At the same time, we have also seen increased volatility in the bond markets.

To put this into context, the annual inflation rate in the US rose, unexpectedly, to 8.6% in May, the highest level since December 1981 and above the 8.3% reading the prior month. In the UK, inflation is at a 40 year high of 9% and forecast to move higher in the short term. Likewise in the Eurozone, inflation jumped to 8.1%.

Whilst the current environment of higher inflation was initially fueled by the response of governments to the pandemic, with many countries providing significant stimulus measures in one form or another, more recently, additional inflationary pressures have come in the form of the war in Ukraine – But please do not be confused by Main Stream Media – This situation has not been as a direct result of the Ukraine conflict, and would have happened regardless – With that said the atrocities have undoubtedly added global concern and exacerbated the outcome. This has severely curtailed exports of key commodities such as wheat, corn and barley whilst sanctions imposed on Russia have impacted its exports of oil, gas, steel, aluminium and fertilisers. Taken together with the rolling Covid lockdown restrictions in China, the world’s largest exporter, inflationary pressures have been significant and persistent.

Having previously considered inflation to be ‘transitory’, central banks are waking up to the inflationary threat. Earlier this week, the Federal Reserve in the US announced an increase in base rate of 0.75%, the largest since 1994. The Bank of England followed with a more modest 0.25% rise (to a 13 year high) and the Swiss Central Bank also raised rates for the first time in 15 years. Furthermore, the ECB has signaled its intention to raise rates in July.

Market concerns over rising inflation have been fuelled the fire more recently by the risk of recession, in part due to higher interest rates. On this, many believe the UK and Europe looks more vulnerable than the US. The US is more insulated to energy prices with strong domestic production – its inflation is predominately derived from strong consumer spending and services as opposed to the imported inflation in Europe, driven by energy and food prices.

Response

In response, many of the fund managers have continued to be active in portfolios, making a number of defensive and tactical changes to reflect the deteriorating outlook.

Overall, we believe the changes that the fund managers have been making over recent weeks achieve an appropriate balance between positioning portfolios for the longer-term, when stability returns, whilst providing additional resilience in the face of a particularly challenging investment landscape in the coming months.

These market cycles are not new, they are par for the course, and while we have seen, Covid blip aside, a Bull market (upward trend) for a record period of time (since the recovery from the Great Financial Crisis 2007-2011c) we need to continue to stick to the course. Volatile markets represent value and opportunity for the fund managers and this is where they earn their corn. We all have exposure to the markets – I’m still 100% risk on – Meaning all of my pension and my ISA have ONLY equities– So personally I see and feel exactly the same as you as my funds are as volatile as the markets and fully reflect the full extent of all drops as I have no other asset classes to absorb the drops in value, why? Because times like this I see my contributions as buying more bang for my buck – I’m buying at a discount (fund managers will do this even if you’re not making contributions but without a shadow of a doubt it works better – Every correction, every market crash HAS been recovered from and the markets continue to then go on to fully recover and perform to “higher highs” – until the next blip.

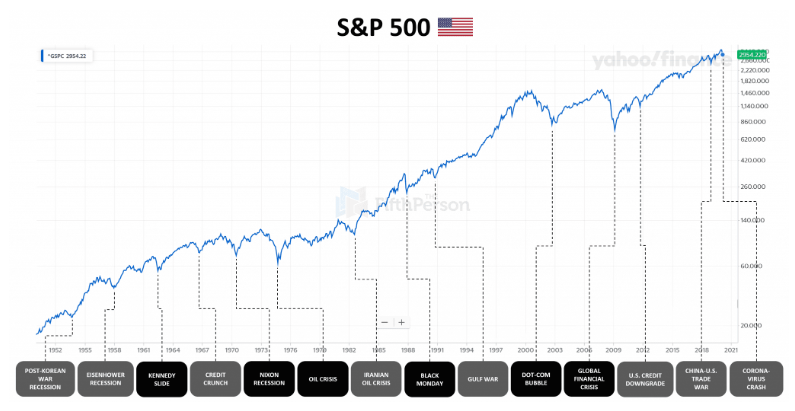

S&P 500

This is a great image of the S&P500 (index tracking the stock performance of 500 large companies listed on exchanges in the United States) since 1952 and the events listed across the bottom: Onwards and Upwards… Remember It’s the Destination not the Journey..

Get in touch with Simple Financial Planning

Get in touch with us today to help you with your financial needs, our aim is to make it simple for you!