Inheritance Tax (IHT) Planning is not relevant for everyone, but for those that it affects it is vitally important and could end up costing your family hundreds of thousands of pounds if ignored. This article is really to help dispel some of the myths around IHT planning and give some food for thought. Please note this is not advise and you should always consult your financial advisor before making and tax planning decisions and IHT is no different, for some of these processes are irreversible and you may cause more harm if mistakes are made.

Inheritance Tax (IHT) Planning is not relevant for everyone, but for those that it affects it is vitally important and could end up costing your family hundreds of thousands of pounds if ignored. This article is really to help dispel some of the myths around IHT planning and give some food for thought. Please note this is not advise and you should always consult your financial advisor before making and tax planning decisions and IHT is no different, for some of these processes are irreversible and you may cause more harm if mistakes are made.

The Essentials

Essentially an individual gets a basic allowance of £325,000 (correct at time of writing 18/06/2021), this means that the first £325,000 of all of their belongings (including a house) is exempt from IHT as it’s within this Nil Rate Band (NRB). If you are a homeowner you are entitled to a further £175,000 which is called your Residential Nil Rate Band (RNRB). Now if you have a married couple and one person passes away, all of their estate can pass to their spouse free of all IHT (so long as a relevant will is in place – this is very important as with no will the survivor is not entitled to 100% of the full estate being left by the deceased) surviving person if there are children.

Assuming no gifts have been made by the first person, the surviving party is able to “inherit” the deceased persons NRB and their RNRB (again assuming the will allowed left everything to survivor) – This in theory means the second person to die has £1million worth of NRB’s (£325,000 + £325,000 from deceased spouse) and the same again on RNRB (£175,000 + £175,000))

Now this is going to be more than suffice for many families as the children can in effect receive an estate of up to £1million and have no IHT bill to pay – Again assuming there have been no use of the NRB via gifts etc in the lifetimes of the parents.

It Gets a Little More Complicated

It Gets a Little More Complicated

Where it gets a little more complicated is when the estate is valued at more than £2million in total (including the house), for every £2 of the £2million you will lose £1 of the RNRB (£175,000 +£175,000 = £350,000 in our example) – So therefore £700,000 over the £2million mark would complexly eradicate the full RNRB for both parties. Leaving a tax bill of 40% on those £350,00 exposed assets which is £140,000 extra in IHT the estate would need to pay. Now we consider the IHT bill on an estate worth £2.7million is now going to be £820,000.

There are a variety of ways in which IHT can be mitigates against, but as mentioned before speaking to your adviser before doing anything, the most common issue we come across with DIY’ers is the house. Mortgage free and transferred to the children as “gift”. Many clients think that after 7 years it’s out of their estate – Not true, this would be classed as a gift with reservation if you were to remain in the property and gift to your children, and essentially would be added back into your estate and be subject to full IHT. Not to mention you are giving away assets and this could result in tremendous issues should you child divorce, become bankrupt of heaven forbid fall out with you! Potentially leaving you homeless.

Some things to discuss with your adviser when it comes to IHT:

- Your pension position – As things stand pensions are exempt form IHT

- Your annual gift allowance, £3,000 to anyone, then several smaller ones for birthdays, wedding etc.

Gifting Using Property Trusts

Gifting using relevant property trusts (i.e. discretionary) – You can still maintain control of the asset but leave to a beneficiary on your death while still being able to take fixed capital repayment out of the trust tax efficiently, generally up to 5% per annum of the amount settled into trust, to help provide income (or you can roll up and defer for amount i.e. 5% per annum after 4 years would mean 20% on of lump sum)

Investing in EIS

Investing in EIS, These provide what is called Business Property Relief (BPR) which takes the investment out of the estate after 2 years, also provides 30% income tax relief on the investment amount. Invest £50,000 you will receive £15,000 rebate on last year’s income tax bill (or this years, or for that matter split across the two years), finally investment allows you to defer a Capital Gains Tax (CGT) bill, ie if you sell a second property and the sale pushes you into a higher rate tax bracket (which would be 28%) you could reinvest the proceeds of the sale into the EIS and pay no IHT until the investment term ends – Normally 5 years, you could then reinvest again deferring the same tax bill.. In effect you could do this until you die and never have to pay the CGT bill, and even in death there would be no IHT potentially as qualifies for BPR as above.

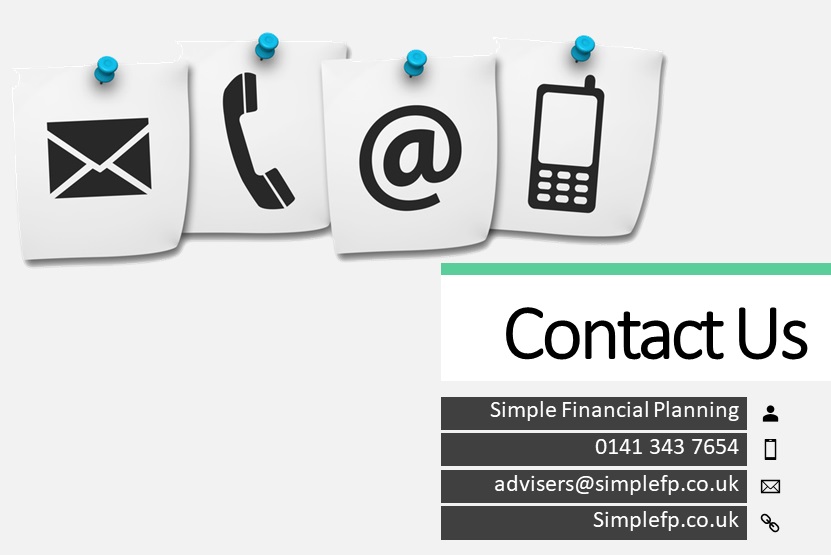

Get in touch with Simple Financial Planning

Get in touch with us today to help you with your financial needs, our aim is to make it simple for you!