Many of you are aware that making regular contributions are key to achieving your retirement planning goals, what you might not be aware of is that it is the contributions that you make while markets are performing poorly that contribute more to the overall value at the point of retiring.. This is through what is called Pound Cost Averaging – I will have undoubtedly discussed this with you (perhaps in passing) and while you may remember the terminology you may have forgotten what it is and the importance – It, along with compound interest effect, is the reason why long-term investing (particularly pension and retirement planning) works like magic, but here is a few actual example using numbers below.

Many of you are aware that making regular contributions are key to achieving your retirement planning goals, what you might not be aware of is that it is the contributions that you make while markets are performing poorly that contribute more to the overall value at the point of retiring.. This is through what is called Pound Cost Averaging – I will have undoubtedly discussed this with you (perhaps in passing) and while you may remember the terminology you may have forgotten what it is and the importance – It, along with compound interest effect, is the reason why long-term investing (particularly pension and retirement planning) works like magic, but here is a few actual example using numbers below.

*Reminder- Pound Cost Averaging is the concept of making regular contributions to your investments in order to smooth out market volatility.

By making regular contributions you naturally purchase fewer units when prices are high and more units when prices are low.

Over the long-term, not only does this create a disciplined investment approach, but this strategy will help take advantage of volatile periods and potentially improve your returns.

Timing the market

One of the greatest things about Pound Cost Averaging is that it removes the worry of making a lump sum investment right before a market decline – This is also a key reason why we generally set up ongoing fees as monthly as opposed to yearly.

Trying to time the market rarely pays off and often it’s more luck than skill- so even seasoned investors avoid falling into this trap. Using Pound Cost Averaging you can be safe in the knowledge that through volatile periods your money will be working to ensure you purchase units at a lower price with a long-term view.

Rising Markets

Of course, there will be exceptions to this philosophy and there is no guarantee that Pound Cost Averaging will result in better outcomes than one-off/lump sum investing.

One of these exceptions is a consistently rising market where investing a lump sum from the outset will give you the lowest possible unit price and therefore generate the highest return.

However, the investment journey is rarely a smooth one and given no one knows for sure that markets will consistently rise over your investment journey, the Pound Cost Averaging method can be a useful tool to ensure you don’t buy at the wrong time and are able to take advantage of market volatility.

Examples

BELOW: Example 1 shows the Pound Cost Average method for two different customers over a volatile period.

Customer A invests £1,000 a month over the year whereas Customer B invests £12,000 in January. Across the year, the market falls and rises with the unit price following the same trend.

By December, Customer A has been able to take advantage of falling prices and has purchased over 1,000 more units and paid a lower average price than Customer B. This leaves Customer A with almost £2,000 more over the 1-year time frame.

| Month | Unit Price | Customer A Contributions | Customer B Contributions |

| January | £2.00 | £1,000 | £12,000 |

| February | £1.91 | £1,000 | – |

| March | £1.74 | £1,000 | – |

| April | £1.70 | £1,000 | – |

| May | £1.65 | £1,000 | – |

| June | £1.57 | £1,000 | – |

| July | £1.52 | £1,000 | – |

| August | £1.57 | £1,000 | – |

| September | £1.61 | £1,000 | – |

| October | £1.65 | £1,000 | – |

| November | £1.74 | £1,000 | – |

| December | £1.83 | £1,000 | – |

| Total Unit Purchased | 7,077 | 6,000 | |

| Average Price Paid | £1.71 | £2.00 | |

| Final Value | £12,923 | £10,956 | |

Example 2A

ABOVE: The purple line shows investment in the ABI Mixed Investment 20-60% shares with a single payment of £24,000 whereas the orange shows regular £1,000 contributions over the same period.

Example 2A, shows a real example of how using Pound Cost Averaging through the last financial crisis in 2007 to 2009 may have been beneficial.

You can see that the Pound Cost Averaging method here has resulted in a greater number of total units purchased, a lower average price paid and a higher final value.

Example 2B

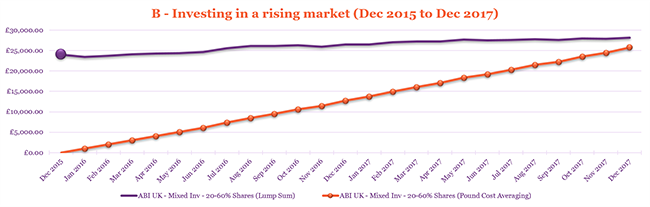

ABOVE: Example 2B then shows a real example (using the same basis as in Example 2A) of how the Pound Cost Averaging method may result in poorer outcomes in a market which overall, has net positive returns.

What it really comes down to however, is individual investor preference. Using either method (or even a mixture of both) a well-structured, long-term investment strategy should help you on the way to building enough investments to support you through retirement.

I hope this helps and makes sense, again I appreciate that things are tough right now, money is tight, costs are high. However by the best way to give your retirement planning that BIG boost is to regularly contribute to it – From a psychological point it massively helps me deal with the ups and downs in the market – When the markets are doing well I’m happy, when the markets aren’t doing so well I remind myself that I’m adding under value assets into my portfolio and that can only be a good thing.

For the record, the fund managers are looking for opportunities like this manually to buy undervalued assets to get the same outcome, its effective but not as effective as also regularly contributing.

One last this.. Remember for every £80 you contribute from your own money the government will also apply £20 tax relief and add it to your £80 meaning you are getting £100 into your investment (this is 20% tax relief – £80/0.8) meaning your payment has gained a guaranteed effective 20% RISK FREE, overnight even without any natural growth. This is as of todays date and may change in the future, likewise investments can go down as well as up.

If you have any questions, please reach out..

Get in touch with Simple Financial Planning

Get in touch with us today to help you with your financial needs, our aim is to make it simple for you!

INVESTMENTS CAN GO UP AND DOWN AND YOU SHOULD ALWAYS CONSULT A FINANCIAL ADVISER BEFORE MAKING DECISIONS.