We are off to a shaky start in 2022 with some of the gains of 2021 being handed back to the market, at times like this is always important to understand two things.

Firstly

Firstly

The markets go up, the markets go down, the markets go up again. We have seen a relatively positive market (bullish) for almost the last decade (since the Great Financial Crisis (GFC) ended – And we all remember the run on Northern Rock Bank don’t we) Its being deemed as the longest bull market of all time topping the bull run of the 1990’s which lasted 113 months.

Look at the graph below, it shows the history of the American stock index (S&P 500) since the 1800’s, there are major significant events marked – World War 1 and 2, GFC, dot-com crash etc. What we need to remember is that after every crash the market has recovered to the levels that were at BEFORE that crash and then continue to grow to new highs, obviously there has also be much more smaller “corrections” or “blips” but again these have ALL been recovered from then continued to new highs.

Even when the markets crash (because they do fairly regularly as you can see) – This is like a tree shake where all the weak hands fold, and all the computer generated programs hit “stop-loss” levels that trigger more sell offs that perpetuate the drop further. Its like the old self-fulfilling prophecy. I bang this drum all the time, but its how it works… Why not move to cash? Because its not about timing the markets, it’s about time in the markets, which is point two below.

Secondly

We are not gamblers, we are not in the habit of betting on long shots, we play the market and play the game, and my job remind you that everything we do together is calculated and thought through – The length of time you have until retirement, the amount you have in your fund, the amount you need to achieve in retirement, the risk that you are currently taking in order to get there. So anyway back to the question, why not sell off to cash – Well inflation is currently over 5% so having the money sit in cash means its dropping in actual value by 5% every year, £100,000 on the 27/01/22 will still show as £100,000 in 27/01/23 but it will only buy £95,000 worth of goods. But more importantly you need to stay invested because its too dangerous to catch a “falling knife” many extremely clever people have tried to time the market and failed, its like trying to boil the ocean, not going to happen.

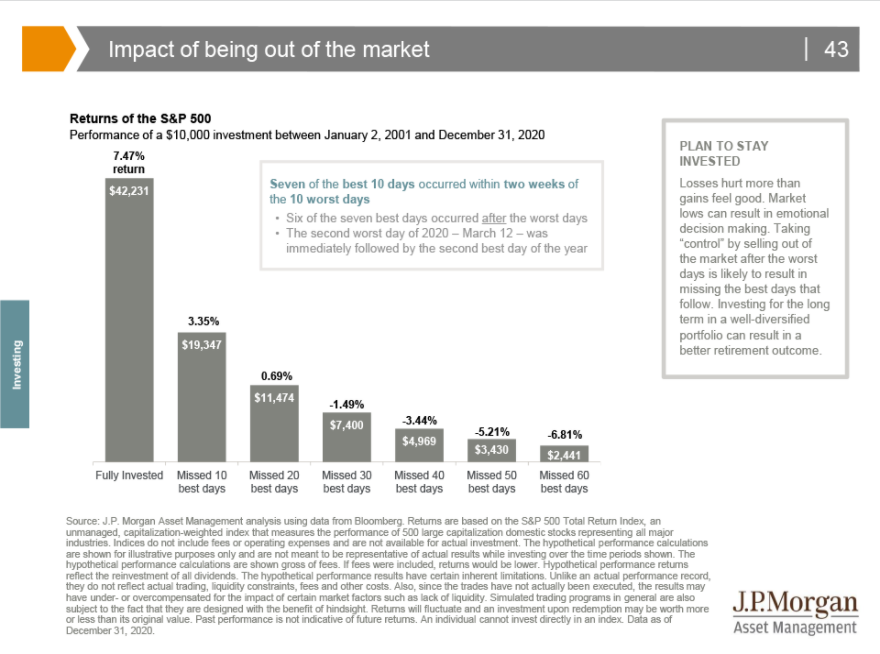

Look at the FACTUAL illustration below, it assumes a $10,000 (sorry its an American article) invested in 02/01/2001, if left untouched for 20 years (until 31/12/2020 bearing in mind this included COVID which was March 2020 the crash happened) it would be worth $42,231 (7.47% compounded return per annum), now lets assume we missed ONLY the best 10 of the 7300 days between these periods (before someone points out it will be more than 365 * 20 as there are leap years I have just used simple maths!) the value drops to $19,347 (3.35% compounded returns per annum) that’s halved the return. For missing only 10 days. If you want to take it further if you were to miss somewhere between 20 and 30 days you would actually have made a loss. Take a second to think about that. Your fund would be under the £10,000 that you initially invested. What’s really interesting is that 7 of the best 10 days occurred within two weeks of the 10 worst days so even if you could predict the drop (which you can’t) you need to be lucky enough to get back in quickly enough to get the best days.

Summary

In summary we need to remember that your annual reviews are extremely important – To make sure I am kept abreast of your plans and whether anything has change that we need to consider – Change in income target, change in age of retirement etc. Also to make you aware of what is going on and any changes that we should make – Be it strategy wise or other, always remember when others are panicking its important to keep your head, and in the words of our friend Warren Buffet “When others are selling, you should be buying” – Meaning you should always be saving what ever you can, but the real value comes when you are saving in a downward market as you are buying at a discount.

Get in touch with Simple Financial Planning

Get in touch with us today to help you with your financial needs, our aim is to make it simple for you!