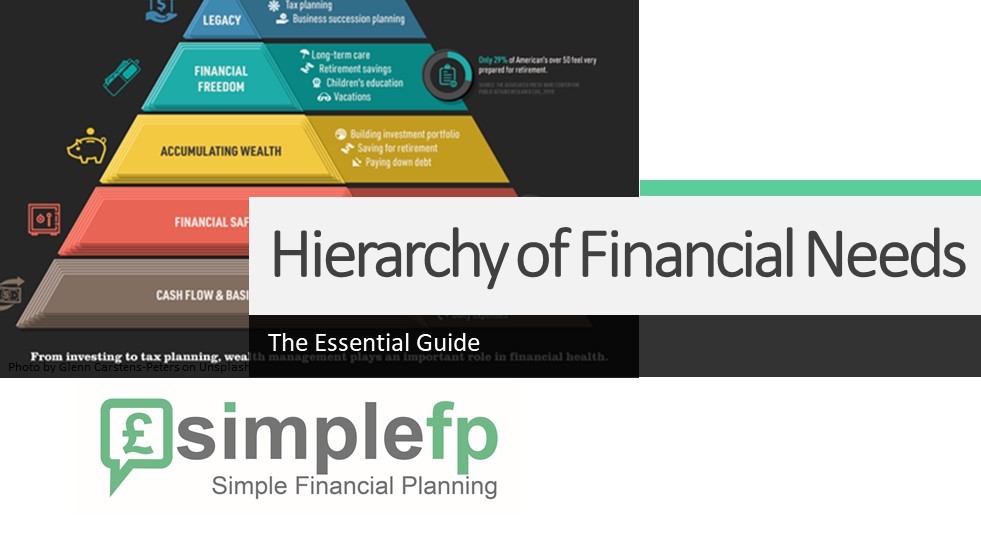

As humans, we follow a basic hierarchy of needs in life most of which is subconscious. Proven by Abraham Maslow in his book titled ‘A Theory of Human Motivation,’ it demonstrates how humans categorise their needs and make decisions, including financial decisions.

As humans, we follow a basic hierarchy of needs in life most of which is subconscious. Proven by Abraham Maslow in his book titled ‘A Theory of Human Motivation,’ it demonstrates how humans categorise their needs and make decisions, including financial decisions.

Understanding the hierarchy and how it drives your financial decisions can help you create a stronger financial foundation.

Steps to Follow for a Better Financial Decision Making

In the chart below, you can see an illustrative explanation of the Hierarchy of Financial Needs. Humans go through each stage, one level at a time, asking important questions and making decisions that affect the next stage.

Here’s a breakdown of each stage, the decisions you encounter, and how to make the most of your financial decisions.

1. Cash Flow & Basic Needs

Your basic needs are those needed to survive – food, housing, transportation, and the daily cost of living. These are the expenses you ‘must spend’ to live a comfortable life. For example, you need a place to live, a way to get around, and food to keep you healthy.

On average, UK employees make £31,461 per year (this varies by profession). Housing costs an average of £868 for private properties and £442 for social renters.

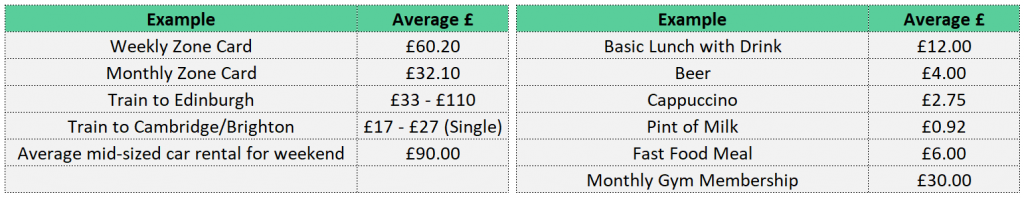

Transportation can be broken down by category:

i. Transportation ii. General Living Expenses

2. Financial Safety

Once you satisfy your basic needs (costs necessary to survive), the next most important decision is saving for financial safety, aka emergencies.

At a minimum, you should have three months of expenses saved in an emergency fund. The average person should have £4500 to cover three months of expenses. As three months is the bare minimum, having a full 12 months’ worth of expenditure (£18,000) saved away is beneficial to weather any storm and would help you to not selling your assets at the wrong time to cover any expenses in an emergency.

You do not have to save this all at once but making regular (even small) contributions will help you reach your goal. Determine how much room you have in your budget to contribute to your savings and automate it. This eliminates the risk of forgetting to save or not having enough to set aside.

Within your financial safety decisions, also consider insurance if you have not be able to save the amounts above. The right insurance policy can protect your future financial needs should you experience a crisis. Insurance policies to consider include:

Unemployment Cover

Income Protection

Mortgage Payment Protection

3 . Accumulating Wealth

. Accumulating Wealth

Once you satisfy your basic needs and set aside enough money for emergencies, you can focus on building wealth. This too doesn’t happen overnight, but if you leave room in your budget for consistent contributions, you’ll grow your wealth faster by taking advantage of compound earnings.

You can build wealth in one three ways:

i. Building Investment Portfolio

Investing isn’t just for the rich. Today, anyone can invest, even if you have only a small amount to contribute each month. Many brokerage firms (especially online) don’t require a minimum deposit, allowing anyone to create an investment portfolio. The earlier you create a portfolio, the more time it has to grow.

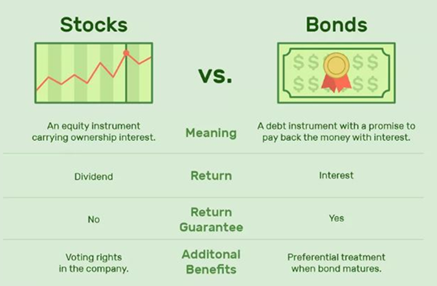

A well-diversified portfolio consists of:

· Bonds

This is your ‘low risk’ investment. Bonds have a guaranteed rate of return, are liquid, and rarely default (if you choose government bonds). They add a safety net to your portfolio to balance out riskier investments. You can invest in corporate bonds too, which are safer than stocks (bondholders are paid first) but are riskier than government bonds.

· Stock

This is your ‘riskier’ investment. Stocks offer higher returns in exchange for the higher risk. When you invest in a stock you own a fraction of the company and earn a prorated amount of its dividends (if applicable).

· ETFs or Exchange Traded Funds

Exchange Traded Funds are like stocks as they are traded on the market during regular market hours, but an ETF is a series of stocks and bonds that mimic a specific market. You invest in a diversified asset rather than trying to pick individual stocks and bonds for your own portfolio. ETFs have expense ratios, so pay attention to the fine print before investing.

Exchange Traded Funds are like stocks as they are traded on the market during regular market hours, but an ETF is a series of stocks and bonds that mimic a specific market. You invest in a diversified asset rather than trying to pick individual stocks and bonds for your own portfolio. ETFs have expense ratios, so pay attention to the fine print before investing.

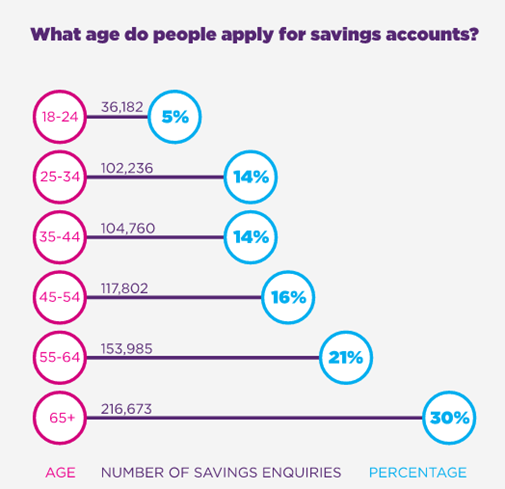

i. Saving for Retirement

Retirement Savings – Contributing to a retirement account through your employer (pension) or on your own (ISA) sets you up for retirement. You’ll get tax advantages now that allow you to defer taxes and save money for when you’re no longer working. You can’t access the funds until ate 55, but that’s how you ensure you have enough for retirement. No one should rely on the state pension scheme, it’s not enough to support anyone’s needs (even basic needs).

ii. Eliminating Debt

You can’t accumulate wealth if you have a lot of debt. Paying high interest rates on consumer debt is an opportunity cost of investing. Don’t think of paying debt down as a liability, but instead an investment. You gain the interest you’d pay on the debt if you left it to accumulate. Once you’re out of debt, you can use the steps above to grow your wealth.

4. Financial Freedom

You can comfortably afford all expenses, you’ve eliminated your debt, and you’re invested to save for short-term and long-term financial goals (retirement). While you shouldn’t let up on your solid financial decisions, you can rest assured that you’ve done what’s needed to achieve financial peace.

When you’ve reached financial freedom, you have adequate savings for your children’s education, a nest egg for retirement, and savings for short-term goals like taking a dream vacation or buying a car or vacation home. Today, studies show only 7% of the UK population has enough money saved for a proper retirement.

These financial milestones are only possible with proper financial planning and working your way through the Hierarchy of Financial Needs.

5. Legacy

No one likes to think about the inevitable, but planning for your death is an important part of your financial plan. Tax planning, estate planning, and business succession planning all set your heirs up for financial success.

Set up your legacy now with the right insurance plans, wills, and trusts to ensure your assets end up in the right hands and have favorable tax outcomes.

Bottom Line

Slowly working your way through the Hierarchy of Financial Needs will naturally set you up for financial success. Jumping categories and heading straight to retirement planning, for example, won’t leave the desired results.

Start at the bottom, taking care of your basic needs, and work your way up, one category at a time. With dedication, careful decision making, and consistent contributions, you’ll achieve financial peace, and rest assured that you set your family up for a solid financial legacy.

Meta Description

To build a solid financial foundation, understand the Hierarchy of Financial Needs and the five stages that help you achieve your financial goals.

Get in touch with Simple Financial Planning

Get in touch with us today to help you with your financial needs, our aim is to make it simple for you!

Reference Links:

https://advisor.visualcapitalist.com/hierarchy-of-financial-needs/

https://www.cosmopolitan.com/uk/worklife/careers/a33179/average-job-salaries-uk/

https://www.nimblefins.co.uk/business-insurance/landlord-insurance-uk/average-rent-uk

https://blog.revolut.com/a/cost-of-living-uk/

https://www.shiftingshares.com/how-to-build-an-investment-portfolio/